Dear Client,

After enjoying two calendar years of brilliant stock gains and rebounding bond returns, we find ourselves on shifting sands as we close this first quarter of 2025.

Much has changed with the turn of the calendar and the inauguration of a new administration. Some of you have expressed deep concerns with this administration’s marked departure from historical norms, from its efforts to expand executive power in ways that strain our system of checks and balances, to its dismantling of government agencies, to its reshuffling of global alliances. It is reasonable to believe these changes will have meaningful political and social ramifications.

We appreciate the disquiet these developments engender, but we limit the focus of this letter, keeping our primary obligation to you at the forefront: ensuring cash flow is available to you in the near-term and protecting the long-term sustainability of your financial assets.

Bonds – a rare free lunch in T-bills

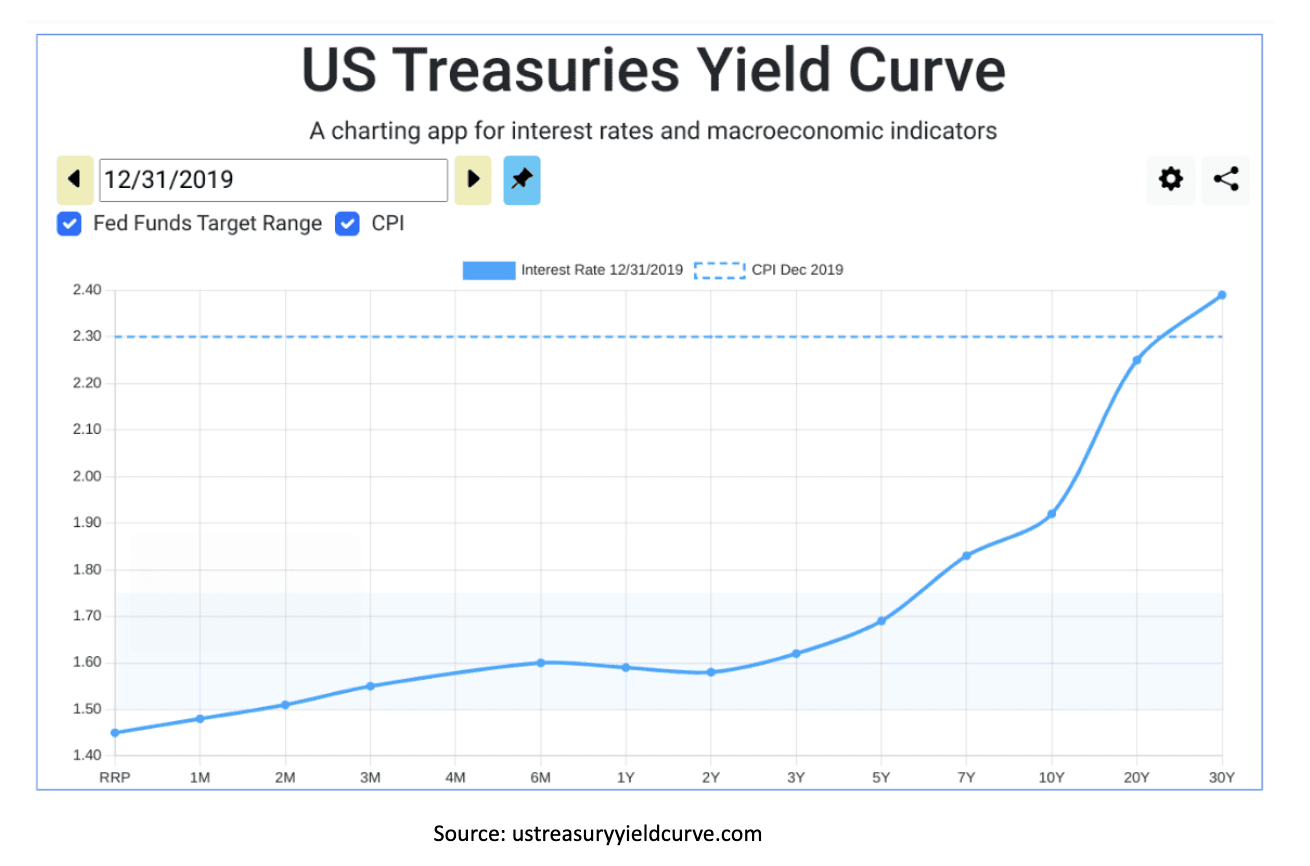

Throughout our firm’s history, we have rarely made a dedicated allocation to individual U.S. Treasurys. But this is exactly what we have been doing steadily for the past 2½ years. You need to look back only five years (January 2020) to see why Treasurys lacked appeal in the past. As the graph below shows, even though inflation was running at a cool 2.3% (dotted blue line), if you wanted to receive a yield above inflation you had to buy the 30-year bond. Treasury yields across the rest of the curve fell short of inflation, guaranteeing a loss of purchasing power for most Treasury investors. The price of safety was simply too high, and we opted for high quality corporate and municipal bonds that offered better (after-tax) yields than Treasurys.

January 2020 was by no means exceptional. Yields at the shorter end of the curve had been trailing inflation for the ten years prior. It was a decade of languor that followed the financial crisis, marked by below-target inflation, tepid economic growth, and a Federal Funds rate largely anchored to zero. You might recall that during this era a sizable swath of government bonds around the world sported negative yields for a spell. That’s right, investors actually paid governments for the privilege of lending them money. Strange times.

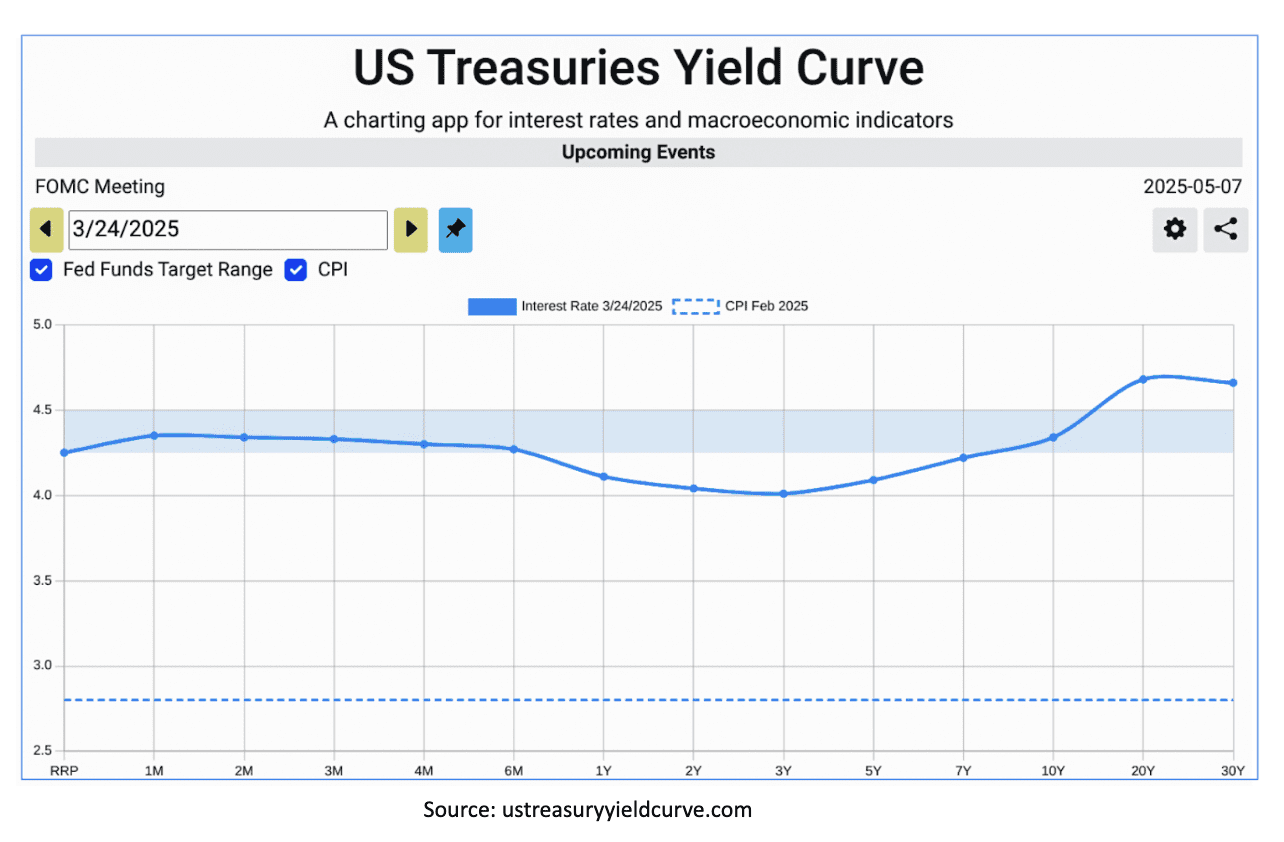

Pandemic-induced dislocations quickly and dramatically shifted the post-financial-crisis dynamic. Inflation rose to levels not seen since the 1970s, economic growth spiked strongly, and the Federal Reserve embarked on an aggressive program of rate increases to subdue rising prices. This sea change gave us our free lunch in U.S. Treasury bills, which we can see in the current Treasury yield curve below, with inflation represented by the dotted line.

Today, Treasury investors across the curve are enjoying much higher absolute yields than in 2020, but more significantly, the yields are 1 to 2 percentage points above inflation. Two things are worth noting about the curve. First, it is not typical for it to be flat or inverted, where the 3-month T-bill yield equals or exceeds the 10-year yield. When inversions occur, they usually last a matter of months, but the current inversion is decidedly long in the tooth, having lasted for the entire 2½ years we have been investing in T-bills. Second – and this is the free lunch we have been eating for two years – it is highly unusual for 3-month T-bill yields to exceed the inflation rate for protracted periods.

Our T-bill strategy has paid a return above both inflation and longer-dated Treasurys without any assumption of risk. Though not quite as bizarre as paying governments to lend them money, earning the highest return in the lowest-risk bonds defies investment logic, and for that reason alone we always understood our T-bill strategy would have a limited lifespan.

It remains to be seen whether the new administration’s controversial policies will be the catalyst that brings our T-bill strategy to an end. That tariffs are inflationary is a rare point of agreement among economists across the political spectrum. But it is not clear whether this administration will use tariffs as a temporary tool for political leverage, in which case they may prove to be more bark than bite, or if it holds a deeper commitment to them in its vision to re-industrialize America. Deportations, if carried out on a mass scale, could also be inflationary by raising labor costs, which businesses eventually pass on to consumers.

Alongside these potentially inflationary policies, the administration has been telling us of late that we should prepare for an economic slowdown. The combination of high prices and slow growth would challenge the Federal Reserve, which is charged with maintaining price stability while maximizing employment, and most certainly would alter the current relationship between inflation and short-term Treasury yields.

At this point, our T-bill trade is still working and this administration’s policies are still very much in flux. These T-bills, along with other short term, investment-grade corporate and municipal bond strategies comprise our full approach to bonds. We will continue to enjoy the safety of these high-quality, short-term strategies for as long as they provide the most favorable balance of risk and return.

Strategic Opportunities – just the right balance

Our middle-risk Strategic Opportunities continue to boost income payouts and act as ballast in portfolios. The overall goal has always been to earn better returns than bonds, but with less risk than stocks. This year is no different. Like our bonds, our core strategies have very little sensitivity to changes in interest rates because they hold securities with short-term maturities. However, unlike our traditional bonds, which are all very high quality, these strategies selectively add credit risk (i.e. dip down into non-investment-grade rated bonds) as a source of additional return.

Current yields are in the 5% to 7% range, but can be as high as 10+% for private investments focusing on corporate debt and real estate bridge loans. Like bonds, income is the primary source of return, but unlike stocks, there is little-to-no expectation of further appreciation – this is what makes them a hybrid, or middle-risk strategy. We continue to value these strategies for their high levels of income and their consistent returns over the past few years. Since most of their income is taxed as ordinary income, we prefer to hold these strategies in tax-sheltered retirement accounts whenever possible.

Stocks – a bumpy ride so far

In just a few short months, stock investors have already experienced quite a roller coaster ride this year. Markets climbed steadily upward to new all-time highs by mid-February, but then plunged as policy uncertainty – from tariff whipsaws to fears of mass federal layoffs – triggered a rapid 10% correction in U.S. stocks. While the current year-to-date performance may not be what we hoped for at the beginning of the year, when much of the focus was on pro-growth policies, many aspects of the economy remain positive. Corporate earnings growth is impressive and broadening, inflation has moderated, wages are rising, and the labor market is remarkably resilient.

It is also important to recognize that short-term market pullbacks, like the one we are currently experiencing, are a natural part of investing. While this can be unpleasant, the reality is that selloffs of this magnitude occur on a regular basis. In fact, the S&P 500 experiences an average drop of over 13% each year, but notably, still ends in positive territory in most years. Staying disciplined through short-term market stress is critical to ensure you remain invested and benefit from strong stock returns when the market inevitably rebounds.

New year, new leaders (from Mag 7 to Lag 7)

Newspaper headlines and never-ending alerts on our phones have many feeling overwhelmed and anxious about their investment portfolio. While there are areas of stock weakness, our globally-diversified approach has worked well amidst the market turbulence so far this year. In fact, you may be surprised to know that international stocks are positive despite the selloff here at home.

U.S. large cap stocks have been, by far, the best performers over the past two years. In particular, the “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), which comprises a third of the overall weight of the S&P 500, accounted for most of the index’s returns over that time. But the tables have turned this year, and the Mag 7 is down 10%. Given the concentration in these stocks, year-to-date they have pulled the S&P 500 Index down 2% for the year, even as the other 493 stocks are up 2%. While these stocks are weighing on performance, we are glad to see market leadership broaden.

U.S. small cap stocks have also struggled so far this year based on worries that tariffs could reignite inflationary pressures, potentially leading to higher interest rates and borrowing costs. For smaller companies that rely on external financing to operate and grow their businesses, this has been a big headwind. While valuations are reasonable, the Russell 2000 Index is down over 5% year-to-date. Should there be a policy reversal, or simply some clarity of planned policy, the cloud of uncertainty should be lifted and a swift rebound is plausible.

On the flip side, overseas markets – despite trade tensions – have flourished this year on attractive valuations, a weaker dollar, and fiscal tailwinds. International developed stocks are up 6% in local currency, and close to 10% when factoring in the weakening U.S. dollar. And emerging market stocks are also up nicely, returning over 6%. The stark performance divergence from last year underscores how quickly market sentiment can shift, and serves as a timely reminder of the importance of a global diversification.

We recognize and appreciate that we are living in a politically charged and unusually uncertain time, where stock market weakness can be especially alarming. Through experience, we have learned that maintaining a long-term investment approach is the most effective strategy for navigating market volatility. While short-term market swings can be unsettling, those who stay invested through challenging periods are in a better position to achieve their long-term financial goals.

As always, we want to be your first point of contact when you have a question or concern, and we look forward to working with you throughout the year.